Compare Secured Loans

Consolidate debts or make home improvements with a secured loan from £15k to £500k

-

Borrow more for less – we’ll get you a great deal

-

Loans from £15K – £500k over 1 – 30 years

-

Access funds in as little as 11 days

-

Your free quote won’t affect your credit score

-

Rated ‘Excellent’ on Trustpilot

-

Borrow more for less – we’ll get you a great deal

-

Loans from £15K – £500k over 1 – 30 years

-

Access funds in as little as 11 days

-

Your free quote won’t affect your credit score

-

Rated ‘Excellent’ on Trustpilot

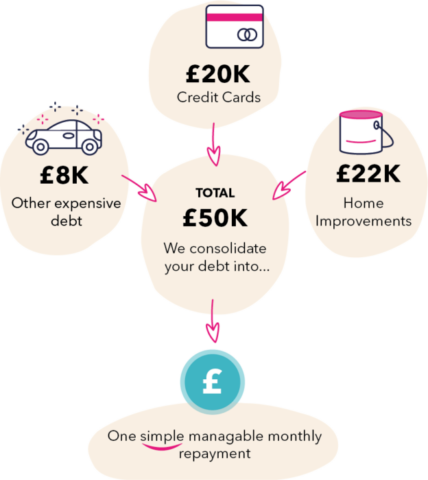

You could reduce your monthly payments by up to 75% with a debt consolidation loan

Struggling with debts? Dreading the monthly direct debits going out of your account? A secured loan could consolidate everything into one manageable monthly payment – giving you room to breathe!

- Consolidate credit cards and loans

- Make some home improvements

- Get rid of other expensive debts

- Have money left over every month!

It’s quick and easy to get a free quote and see how much you could save.

Get Your Free Quote

3 easy steps to your perfect secured loan

It's quick, simple and free to start comparing secured loans with us

1. Apply online

Complete our online application and we’ll connect you with a specialist secured loan adviser

2. Chat with an adviser

Calculate how much you could borrow and what loans you could get based on personal circumstance

3. Choose your loan

Take the time you need to make a decision, then let your adviser do all the paperwork for you

Verified customer reviews

Ben Young

“ These guys were so helpful. Gave me great advice and helped me secure a loan at a great rate for my garage conversion. Would definitely recommend to friends and family. ”

Jake Wilson

“ These guys helped me get a loan at much better rates than what I was getting quoted with local brokers, thank you! ”

Alex Pearce

“ Had a really good experience regarding arranging a secured loan. They introduced me to a great advisoer. Thanks for the help. ”

Dana Huggins

“ Smooth experience with Money Saving Advisors. Communication and time frame were exceptional. For once a loan transaction without stress and complications. Very impressed and highly recommended if you’re looking for a competent company to see your unsecured loan through without going grey or losing your hair entirely. ”

Frequently asked questions

You borrow a secured loan by using something you own as collateral, such as property, vehicle, jewellery or art. The asset’s value determines how much you can borrow, and you risk losing the collateral if you cannot make your repayments on time.

Our lenders offer secure loans for various credit scores, from excellent to bad. There are products available to suit most credits, and you can check your eligibility here to get expert advice and compare rates.

We have a selection of second-charge lenders who offer loans if you have a bad credit history. Our lenders also accept CCJs and defaults, even if they’ve occurred in the last 12 months. Get in touch with us, and we’ll inform you of the available products and the applicable interest rates for your circumstances.

Yes. Debt consolidation loans are a popular product for our customers. Request a quote, and we can let you know which ones are best for your situation.

Yes, you can sell your house with a secured loan on it. The money from the sale would pay off your secured loan together with your first-charge mortgage. Typically, your conveyancing solicitor will handle this aspect and deal with the lender during the sale process.

A limited number of lenders offer a maximum loan-to-value (LTV) of 95%. These products are more expensive as they have higher interest rates. Lenders of high-LTV products limit borrowing to smaller values.

Find your best secured loan now

Compare 100’s of secured loan deals quickly and easily

Get Your Free Quote